Modern Theory of inflation:

Definition:

Inflation

is a situation when price increase is Irreversible in the market .it is called

inflation.

Definition

in Money Market:

Inflation

is a condition of rise in the stock of money, under this situation to much

money chases to few goods.

Definition

in good market

Inflation

is the condition of generalized excess demand in the goods market.

Definition

in international market

Inflation is a fall in the external value of

money as measured by foreign exchange rate or by price of gold.

Classification/Types

of inflation

1. Open or suppressed inflation.

2. Creeping/moderate

3. Galloping/hyperinflation

4. Anticipated and unanticipated

5. Demand pull

6. Cost push

7. Administrative inflation

1. Open or suppressed inflation.

2. Creeping/moderate

3. Galloping/hyperinflation

4. Anticipated and unanticipated

5. Demand pull

6. Cost push

7. Administrative inflation

Criteria

for classification

1. Working of market

2. Rate of which price are increased

3. Expectation about inflation

4. Causes of inflation

1. Working of market

2. Rate of which price are increased

3. Expectation about inflation

4. Causes of inflation

Explanation

and definition of demand pull inflation what are its causes and remedies to

control it

Definition

of demand pull

Demand

Pull inflation is actually the

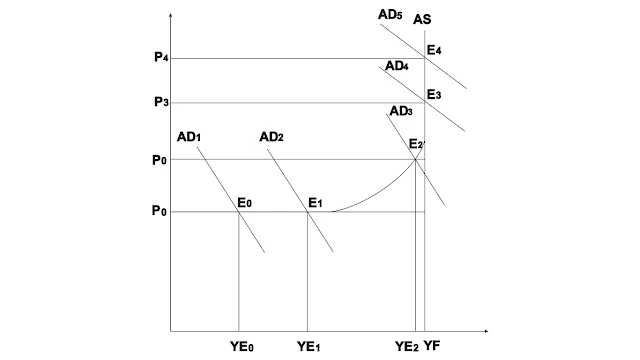

concept of classical economist. according to them demand pull inflation is a situation when aggregate supply remaining the same and aggregate demand is increased as shown in the diagram explanation in the above diagram

concept of classical economist. according to them demand pull inflation is a situation when aggregate supply remaining the same and aggregate demand is increased as shown in the diagram explanation in the above diagram

Figure 3.1

Explanation:

In

the above diagram AS and AD interest at point E0. At this point level of

employment P0 Is YF and level of price is P0. Now, if Aggregate Demand (AD)

increase it will be shift upward from AD0 to AD1 and new equilibrium point is

E1 level of employment remain same, but price level increase from P0 to P1 due

to increase in aggregate demand.

We can use IS-LM approach to explanation of demand pull

inflation.

Figure 3.2

Explanation: In the diagram three market equilibrium at

point E0 level of employment is YF and price level P0 if money supply increases

LM curve shift right down ward new equilibrium level of point E1 level of

employment determined by this point is YA which is above full employment level and

price determined in the market is 0P1.now it is clear that when money supply

increases in the country price level also increase. When price level increased

LM1/P0 shift upward left which shows that real purchasing power of peoples

decrease and LM1/P1 reach at point EO and this procedure is continuous until it

reach at point E3 at this point level of employment is YB which is below the

level of full employment price level also increased from 0P1 to 0P3 Smoothly.

Demand

pull inflation in Keynesian view

in Keynesian framework increase in demand will

not immediately bring an increase in price level but after a certain point man aggregate

supply (AS) curve become vertical straight line increase in demand will bring

an increase in price level. It will be called demand pull inflation or pure

inflation in Keynesian analysis as shown in figure 3.2

Figure 3.3

Explanation: in

this diagram according to Keynesian employment AD1 interest AS curve at point E0

equilibrium level of employment is YE0

and

price level is PO if a d curve shift right ward and intersect at point E1 level

of employment increase from YE0 To YE1 but price level remain same it is clear

that in first part AS curve if AD increase in this part level of employment

increase but price level remain constant and there will no inflation in first phase

of AS curve

2nd

in second phase of AS curve if ad increases and due to this change price also will

also change. We call it bottle neck inflation as shown in figure 3.2 above Ad2

shift to right upward and intersect at E2 at this point employment level

increase YE1 to YE2 price level goes up P0 to P2 in this part of is AS curve as

aggregate demand (AD) increased level of employment and price level will also increase.

According

to Keynesian model when we reach in 3rd phase of aggregate supply (AS) curve, The

demand pull inflation will create as aggregate demand (AD) increase and aggregate

demand (AD) curve will shift upward there will be no change in level of full

employment but there will be change in price level increased from P2 to P3 and

P4 as aggregate demand (AD) increase continuously

Causes

of demand pull inflation

1. Increase in the population

1. Increase in the population

As

population of a country increase there will be an increase in the effective demand

and due to this increase in effective demand price level will also increase in

the market and this demand creates inflation in the country.

2. Increase in government non development expenditure

2. Increase in government non development expenditure

When

Government spends on non-development project there will be no increase in

production but supply of money increase in the country and price level has also

increase.

3. Deficit financing:

3. Deficit financing:

If central bank adopt the deficit financing

policy there is increase in the money supply in a country due to this policy

price level goes up in the economy.

4. Increase in circulation of money supply

4. Increase in circulation of money supply

If circulation of money increase in the

country price level will be increased in the economy.

5. Effects of Black Money:

5. Effects of Black Money:

When people invest their black money in the

economy the velocity of money increase due to this price level also goes up and

it will create inflation in the economy.

6. Demonstration effect

6. Demonstration effect

As people increase their expenditure due to

demonstration fact demand of goods will be increase and price level will also increase

in the country.

7. Increase in foreign remittances

7. Increase in foreign remittances

If

foreign remittance is increased to a country there will be increase in real

purchasing power of the people. The demand for goods will also increase as

resulting the price level will be increased.

8. Spend thrift society

8. Spend thrift society

If

people of the country are spend thrift they purchase more goods and demand of

things will be increase due to this change in demand price level will also be increase.

9. Increase in cost of imports

9. Increase in cost of imports

If

cost on imports are increased the price of imported goods will also be

increased.

10. Inelastic agriculture production

10. Inelastic agriculture production

If

Agriculture sector yield remain same but demand of goods increase by the people

price of goods will also be increased in the country.

Remedies

to control demand pull inflation

- Control on the population of a country.

- By reducing the circulation of money.

- By controlling the demonstration effect.

- Increase in the production of goods.

- To control the cost of production.

- Reduction in the money supply.

- By controlling the social evil, like monopoly.

- Control on non-development expenditures of government

Author: Nasir Mehmood Ch مصنف: ناصرمحمود چوہدری

Email: Nasirmehmoodch97@gmail.com

.png)

.png)

0 Comments